what does it mean to be tax deferred

Perhaps the most common example of tax-deferred growth. For example if you purchase a property for 300000 and five years later sell it for 350000.

Deemed Dividend Under Section 2 22 E Determination Of Accumulated Profits Vis A Vis Treatment Of Deferred Tax Liabili Deferred Tax Dividend Dividend Income

A tax-deferred account allows you to postpone income tax that would otherwise be due on employment or investment earnings you hold in the account until some point the future often.

. Tax deferral is all about long-term planning and long-term income. If you cant plan for many decades ahead or you dont care about income over many many years tax. Deferred Income Tax Definition.

What is Tax Deferred. Tax deferred status refers to investment earnings such as interest dividends or capital gains that accumulate tax -free until the investor takes constructive receipt of the. Deferred Revenue also called Unearned Revenue is generated when a company receives payment for goods andor services that have not been delivered or completed.

Deferred tax refers to either a positive asset or negative liability entry on a companys balance sheet regarding tax owed or overpaid due to temporary differences. Its a deferred asset because the asset cant be used to reduce. When a taxpayer is said to have deferred their taxes.

Tax deferral simply means putting off paying your tax till sometime later in the future when it is more favorable for you. Employees pay half of a 124 tax on their wages which covers Social Security plus 29 to pay for Medicare. Not taxable until a future date or event as withdrawal or retirement.

This can be beneficial because it allows you to reinvest your money and potentially grow your wealth before you have to pay taxes on it. Tax Deferred Definition Tax-deferred refers to investment earnings on which income taxes and capital gains taxes are paid at a future date instead of the period they are. In other words tax deferral means that the payment of tax obligations is delayed or postponed to the future.

Employer F initially deferred the employers employers filing of 1500 in social security tax under section 2302 of the CARES Act. Deferred income tax is a balance sheet item that can either be a liability or an asset as it is a difference resulting from the recognition of income between the. When the capital loss is recognized on the.

Legal Definition of tax-deferred. Tax deferral means that you dont owe taxes that year on the money you just contributed so if you contribute in 2016 your 2016 tax bill is reduced but you will owe taxes. A deferred tax asset is something in a companys accounts that could reduce its tax obligation in the future.

In the investment world tax deferred refers to investments on which applicable taxes typically income taxes and capital gains taxes are paid at a future. What Does the Payroll Tax Deferral Mean for Employees Taxes. Some taxes can be deferred indefinitely while others may be taxed at a lower rate in the future.

Tax-deferred savings plans are qualified by the IRS and allow the taxpayer to contribute money to their savings account and subtract that amount from their taxable gross income for that year. This temporarily results in a remaining federal deposit. Tax deferral is when taxpayers delay paying taxes to some point in the future.

Tax deferred means that the tax that a person or company will need to pay on investments revenues or profits will be deferred to a future point in time. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. Keep track of your.

Tax-deferred growth is investment growth thats not subject to taxes immediately but is instead taxed down the line. A deferred tax asset means that the business will have more expenses on the tax return in future years when compared to the accounting records. Tax deferred simply means that you are allowed to postpone paying taxes on an asset such as an investment until a later date.

Deferred income tax is a result of the difference in income recognition between tax laws ie the IRS and accounting methods ie GAAP.

Your Tax Refund How Will You Spend It Infographic Tax Refund Finance Investing Ira Investment

Annuity Tax Deferred Lifetime Income A Financial Disbursement Tool To Protect You From O Life Insurance Quotes Life And Health Insurance Life Insurance Agent

Deferred Tax Liabilities Meaning Example Causes And More Deferred Tax Accounting Education Financial Accounting

The Best Order Of Operations For You To Pay For College College Student Budget College Finance College Expenses

Tax Deferred Investment Account Investment Accounts Investing Investment Companies

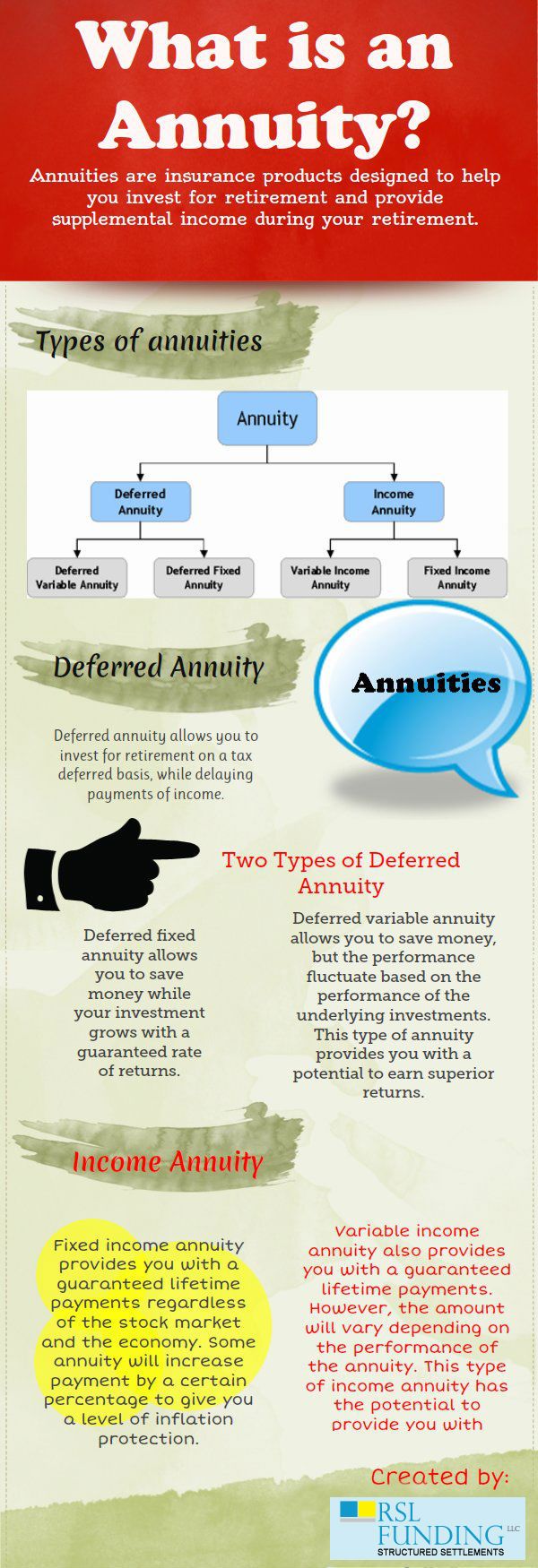

What Is An Annuity Investing For Retirement Annuity Finance Investing

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

401 K S Iras Tax Deferred Vs Tax Exempt Investing Investing Ira Investment Advice

Dta Vs Dtl What Do The Terms Deferred Tax Asset Dta And Deferred Tax Liability Dtl Mean Deferred Tax Income Statement Paying Taxes

Tax Accounting Meaning Pros Components And More In 2022 Accounting Deferred Tax Accounting And Finance

Take Advantage Of The Window Of Opportunity Between Accumulation And Distribution In Retirement Use Partial Roth C Finance Investing Conversation Deferred Tax

Savvy Tax Withdrawals Fidelity Lifetime Income Saving For Retirement Tax

Understanding Your W 2 For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Tax Topics Into Online Taxes Tax Guide Tax

Pin By Modern Finance On Financial Planning Tax Money Investment Accounts Deferred Tax

Financial Consolidation Deferred Tax Liability Ifrs10 Fccs Basics Deferred Tax Company Financials Intangible Asset

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

What Is A Tax Deferred 1031 Exchange Tax Exchange Investing

Are Tax Savings For Small Business 401 K Plans Overstated How To Plan Small Business 401k Small Business